affordable premium

as low as RM250 only

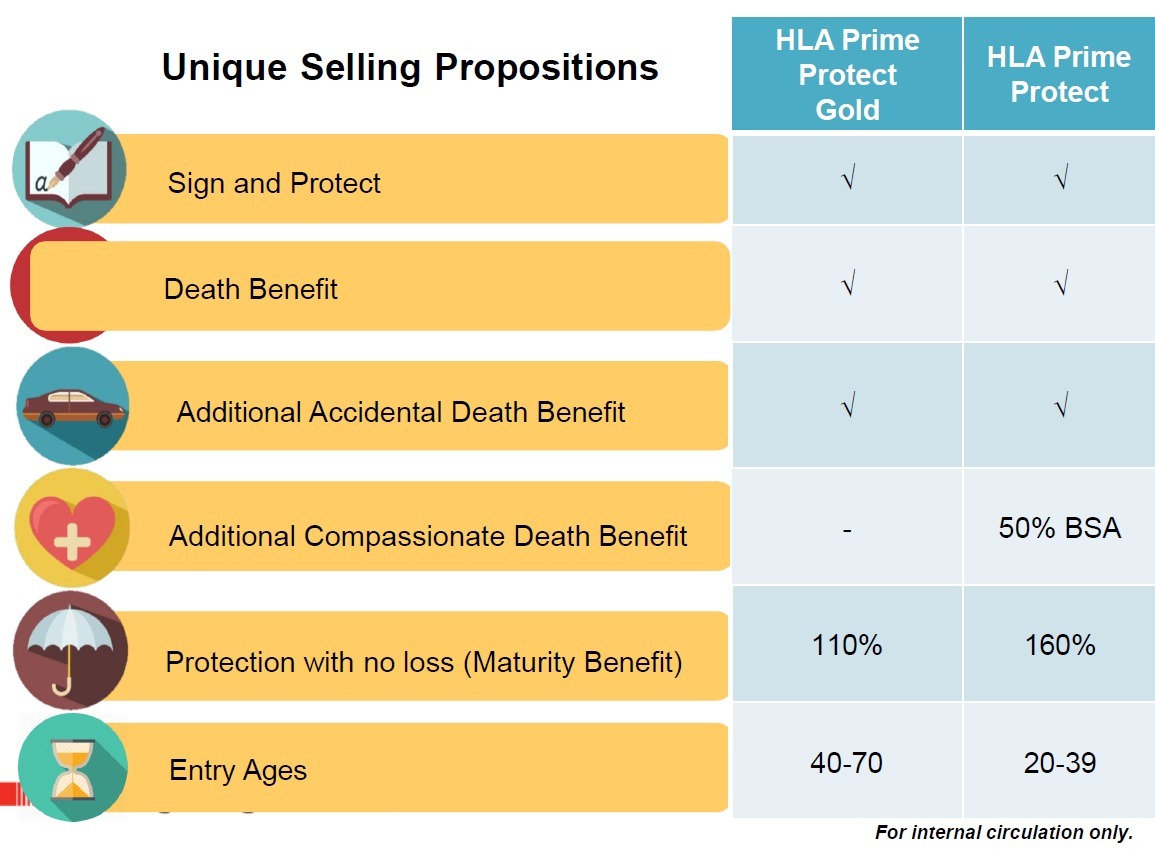

| 1 | Protection at no loss: Get up to 160% premium paid upon maturity |

| 2 | The premium is guaranteed and will remain the same throughout the Premium payment period. |

| 3 | Accidental death protection up to 450% of Basic Sum Assured |

HLA Prime Protect/Prime Protect Gold is an easy sign and protect plan whereby;

a) No health declarations are needed;

b) No medical examination is required;

c) No financial underwriting is needed, but subject to AMLA requirements.

This plan provides protection against death as follows:

Benefit |

Attained Age |

Plan 25,000 |

Plan 50,000 |

Plan 100,000 |

Amount Payable (RM) |

||||

Death Benefit |

40 - 80 |

25,000 |

50,000 |

100,000 |

Additional Accidental Death Benefit |

40 - 65 |

75,000 |

150,000 |

300,000 |

66 - 80 |

37,500 |

75,000 |

150,000 |

|

The Death Benefit will not be lesser than the total premium you have paid or the cash surrender value at any point of time

a) No health declarations are needed;

b) No medical examination is required;

c) No financial underwriting is needed, but subject to AMLA requirements.

Minimum |

Maximum |

|

Age of Entry |

40 |

70 |

Policy Term |

Up to 80 years old |

|

Sum Assured |

Monthly, quarterly, half-yearly & annually |

|

Annual Premium (RM) for Male |

Annual Premium (RM) for Female |

|||||

Entry Age |

Male (25,000) |

Male (50,000) |

Male (100,000) |

Female (25,000) |

Female (50,000) |

Female (100,000) |

40 |

1,030.47 |

1,957.89 |

3,709.69 |

772.85 |

1,468.42 |

2,782.26 |

41 |

1,051.50 |

1,997.85 |

3,785.40 |

788.62 |

1,498.38 |

2,839.03 |

42 |

1,072.96 |

2,038.62 |

3,862.66 |

804.72 |

1,528.97 |

2,896.99 |

43 |

1,094.86 |

2,080.23 |

3,941.50 |

821.14 |

1,560.17 |

2,965.10 |

44 |

1,117.20 |

2,122.68 |

4,021.92 |

837.90 |

1,592.01 |

3,016.44 |

45 |

1,140.00 |

2,166.00 |

4,104.00 |

855.00 |

1,624.50 |

3,078.00 |

46 |

1,201.75 |

2,283.33 |

4,320.34 |

893.00 |

1,696.70 |

3,214.80 |

47 |

1,263.50 |

2,400.45 |

4,548.60 |

931.00 |

1,768.90 |

3,351.60 |

48 |

1,325.25 |

2,517.98 |

4,770.90 |

969.00 |

1,842.10 |

3,488.40 |

49 |

1,387.00 |

2,635.30 |

4,993.20 |

1,007.00 |

1,913.30 |

3,625.20 |

50 |

1,448.75 |

2,752.63 |

5,315.50 |

1,045.00 |

1,985.50 |

3,762.00 |

51 |

1,520.00 |

2,888.00 |

5,472.00 |

1,092.50 |

2,075.75 |

3,933.00 |

52 |

1,591.25 |

3,023.38 |

5,728.50 |

1,140.00 |

2,166.00 |

4,104.00 |

53 |

1,663.50 |

3,158.75 |

5,985.00 |

1,187.50 |

2,256.25 |

4,275.00 |

54 |

1,733.75 |

3,294.13 |

6,241.50 |

1,235.00 |

2,346.50 |

4,446.00 |

55 |

1,805.00 |

3,429.50 |

6,498.00 |

1,282.50 |

2,436.75 |

4,617.00 |

56 |

1,914.25 |

3,636.63 |

6,923.00 |

1,363.25 |

2,590.18 |

4,970.40 |

57 |

2,023.50 |

3,844.65 |

7,348.00 |

1,444.00 |

2,743.60 |

5,198.40 |

58 |

2,132.75 |

4,052.23 |

7,773.00 |

1,524.75 |

2,897.03 |

5,489.10 |

59 |

2,242.00 |

4,260.95 |

8,201.20 |

1,605.50 |

3,050.45 |

5,779.80 |

60 |

2,351.25 |

4,267.95 |

8,645.00 |

1,686.25 |

3,203.88 |

6,070.50 |

61 |

2,595.00 |

4,930.50 |

9,342.00 |

1,885.00 |

3,581.50 |

6,786.00 |

62 |

2,715.00 |

5,155.50 |

9,768.00 |

1,995.00 |

3,790.50 |

7,128.00 |

63 |

2,835.00 |

5,386.50 |

10,200.00 |

2,105.00 |

3,999.50 |

7,578.00 |

64 |

2,938.00 |

5,582.20 |

10,576.80 |

2,188.00 |

4,157.20 |

7,876.80 |

65 |

3,075.00 |

5,831.50 |

11,032.50 |

2,325.00 |

4,417.50 |

8,370.00 |

66 |

3,250.00 |

6,175.00 |

11,700.00 |

2,500.00 |

4,750.00 |

8,940.00 |

67 |

3,450.00 |

6,555.00 |

12,420.00 |

2,700.00 |

5,130.00 |

9,720.00 |

68 |

3,700.00 |

7030.00 |

13,320.00 |

2,950.00 |

5,590.00 |

10,660.00 |

69 |

3,925.00 |

7,457.50 |

14,130.00 |

3,175.00 |

6,025.00 |

11,430.00 |

70 |

4,200.00 |

7,980.00 |

15,120.00 |

3,450.00 |

6,555.00 |

12,420.00 |

Personal tax relief is subject to your eligibility and approval from the Inland Revenue Board of Malaysia.

This product is underwritten by Hong Leong Assurance Berhad, an insurer licensed under the Financial Services Act 2013 and regulated by Bank Negara Malaysia.

(i) Free Look Period

The policy may be cancelled by you by giving a written notice to the Policy Owner(HLA) within 15 days from the date of delivery of the policy to the Policy Owner. HLA will refund the premium paid without interest and any applicable tax after deducting any medical expenses which may have been incurred.

(ii) Important disclosure

You must disclose all material facts such as medical condition and state your age correctly. A nondisclosure of actual medical condition or did not provide full, complete, and true answers in the application/ proposal form may result in HLA avoiding any policy which may be pursuant to the proposal, rejecting or reducing the amount of any claim under such policy or changing the terms of such policy.

(iii) All applications are subject to underwriting approval.

(iv) Please note that the list of FAQ is non exhaustive. Please refer to HLA for the full list of the exclusion under the policy.

Disclaimer

The information provided on this page is not a contract of insurance. The descriptions of cover are a brief summary for quick and easy reference. The precise terms and conditions that apply are in the policy document.

Interested? Please scan the QR code or click here for WhatsApp or submit your contact details in the form below for more information. We will contact you as soon as possible.

Alternatively, you may call to 03-2727 8880 for more information.

Thank you for your interest in our product.

.png)

INFORMATION CONFIRMATION FORM

1. What is this plan?

HLA Prime Protect/Prime Protect Gold is a non-participating endowment plan which provides protection against death up to age 80. This plan is offered on Sign and Protect basis.

2. What are the main differences between HLA Prime Protect (HLAPP) & HLA Prime Protect Gold (HLAPPG)?

3. Can I attach riders to this plan?

No riders are applicable for this plan. All occupation including Scuba Diver (Commercial Using Explosive) can buy this plan.

4. What is the coverage provided by?

This plan provides protection against death as follows:

Benefit |

Attained Age |

Plan 25,000 |

Plan 50,000 |

Plan 100,000 |

Amount Payable (RM) |

||||

Death Benefit |

40 - 80 |

25,000 |

50,000 |

100,000 |

Additional Accidental Death Benefit |

40 - 65 |

75,000 |

150,000 |

300,000 |

66 - 80 |

37,500 |

75,000 |

150,000 |

|

a) Basic Sum Assured;

b) Total Premium you have paid; or

c) Cash Surrender Value

5. What will I receive upon the maturity of this policy?

Returns 110% of premium paid upon policy maturity, provided there are no prior claims.

6. How much is the premium?

The premium is guaranteed and will remain the same throughout the premium payment period.

7. Is the premium guaranteed to be the same throughout the premium payment period?

Yes, the premium is guaranteed and will remain the same throughout the premium payment period.

8. What is the available premium payment method?

You can pay the premium via cash, cheque, credit card or auto debit.

9. What are the payment modes available?

Premium modes available are annual, semi-annual, quarterly or monthly

10. What is the entry age eligible for this plan?

Minimum and maximum entry age (based on age last birthday) as

Minimun |

Maximum |

40 years old |

70 years old |

11. What are the minimum and maximum basic sum assured that I can sign up for?

These are 3 options as follows:

a) RM 25,000

b) RM 50,000

c) RM 100,000

The sum of Basic Sum Assured would be subject to maximum limit of RM250,000 per life.

12. Do I have the option to choose my preferred coverage period and premium payment period?

No, the coverage period for this is up to age 80. The premium payment period is equivalent to the coverage period.

13. Can loading be imposed on this plan?

There will not be any health or occupation loading imposed.

14. Does the occupation of the Life Assured affect the application of this plan?

No, all occupation including Scuba Diver(Commercial Using Explosive) can buy this plan.

15. Can a foreigner enrol for the plan?

No, except Singaporean, Bruneian and those working/residing in Malaysia with Permanent Resident status.

16. Can a corporate enrol for the plan?

No.

17. Can I surrender the plan at any time before policy maturity?

Yes, you may. If the plan is surrendered prior to policy maturity, you are entitled to the cash surrender value as illustrated in the Surrender Value Table in the policy contract.

18. Is policy loan allowable for this plan?

Policy loan is allowed for this plan.

19. What happens if I stop paying the premiums?

After the grace period of 30 days, if the plan has acquired cash surrender value, an amount equivalent to the premium due but not yet paid will be automatically advanced as premium loan.

20. How much do I pay in order to revive/ reinstate policy that lapses?

Revival/ reinstatement is only allowed within 2 years from the first unpaid due date. You may revive/ reinstate the policy by paying the revival amount. Please enquire the Customer Service Department on the revival amount.

21. Is change of plan allowed?

No.