How does it work?

How does it work?

Toyota EZ Beli AITAB is the latest Islamic auto-financing plan from Toyota Capital - Shariah-compliant, fixed profit rate across tenures and lower monthly repayment scheme that differs from the conventional financings.

The abbreviation AITAB stands for Al-Ijarah Thumma Al-Bai' (AITAB), which is Shariah-compliant car financing based on the principles of a lease (Ijarah) followed by a sale (Al-Bai'). The customer is required to pay an agreed repayment payment over a specific period during the leasing contract. Upon expiry of the leasing period, the customer has the option to purchase the asset from the TCAPM at an agreed price.

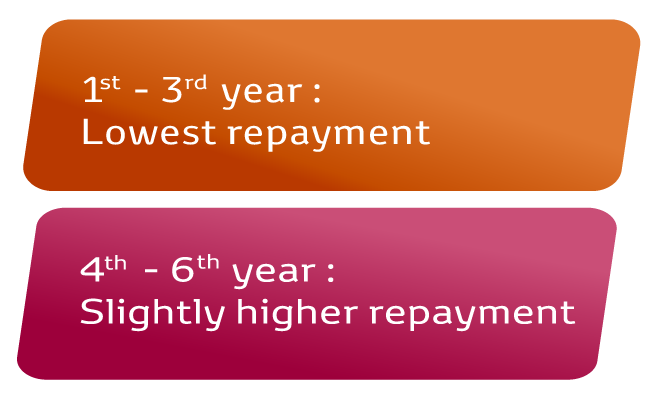

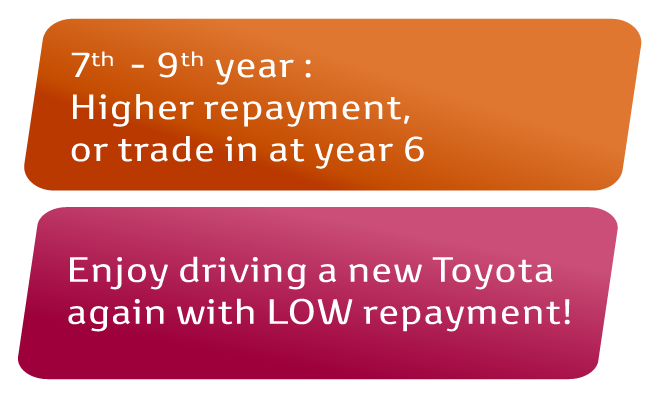

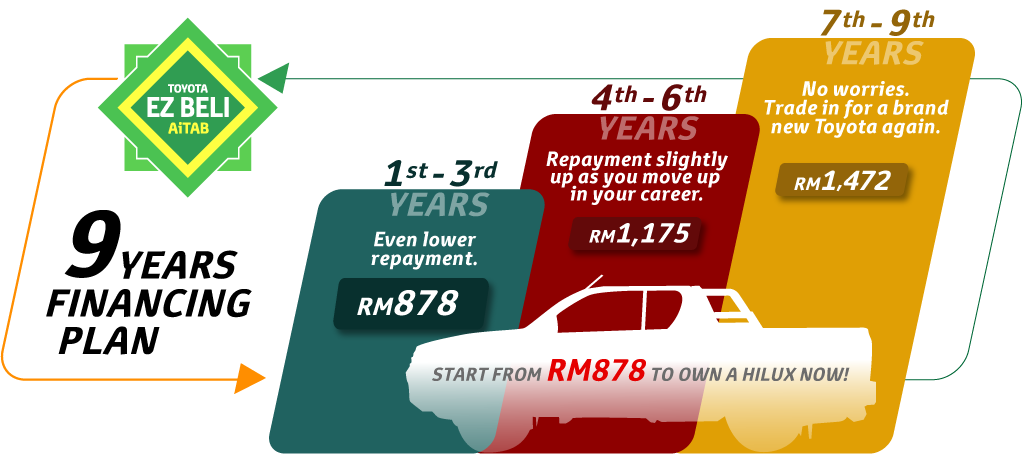

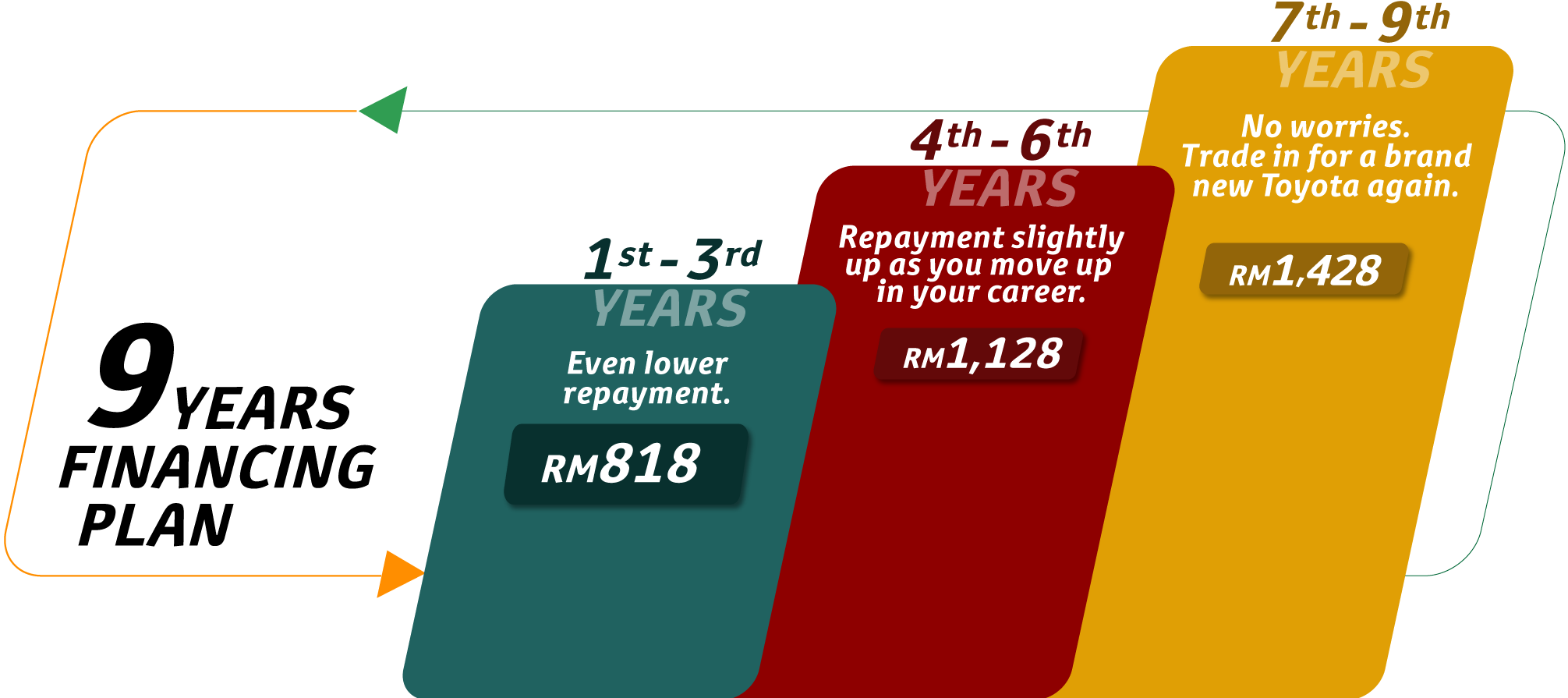

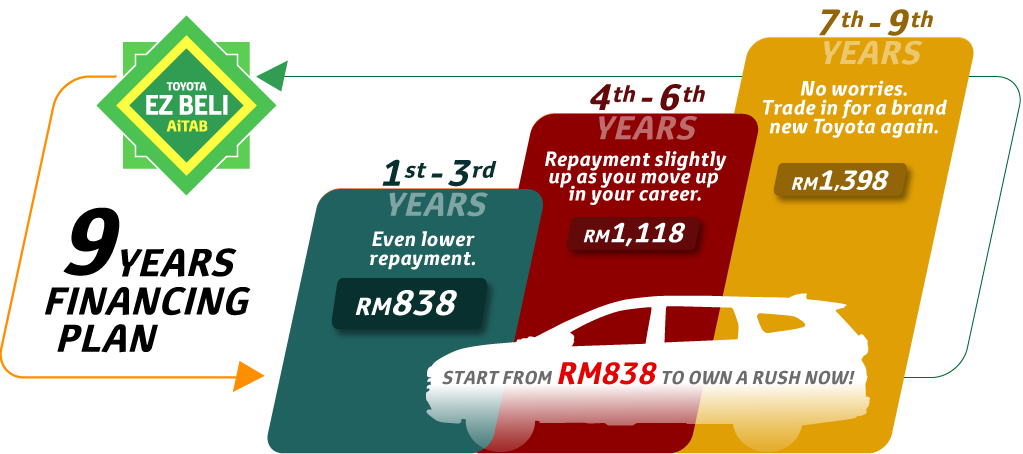

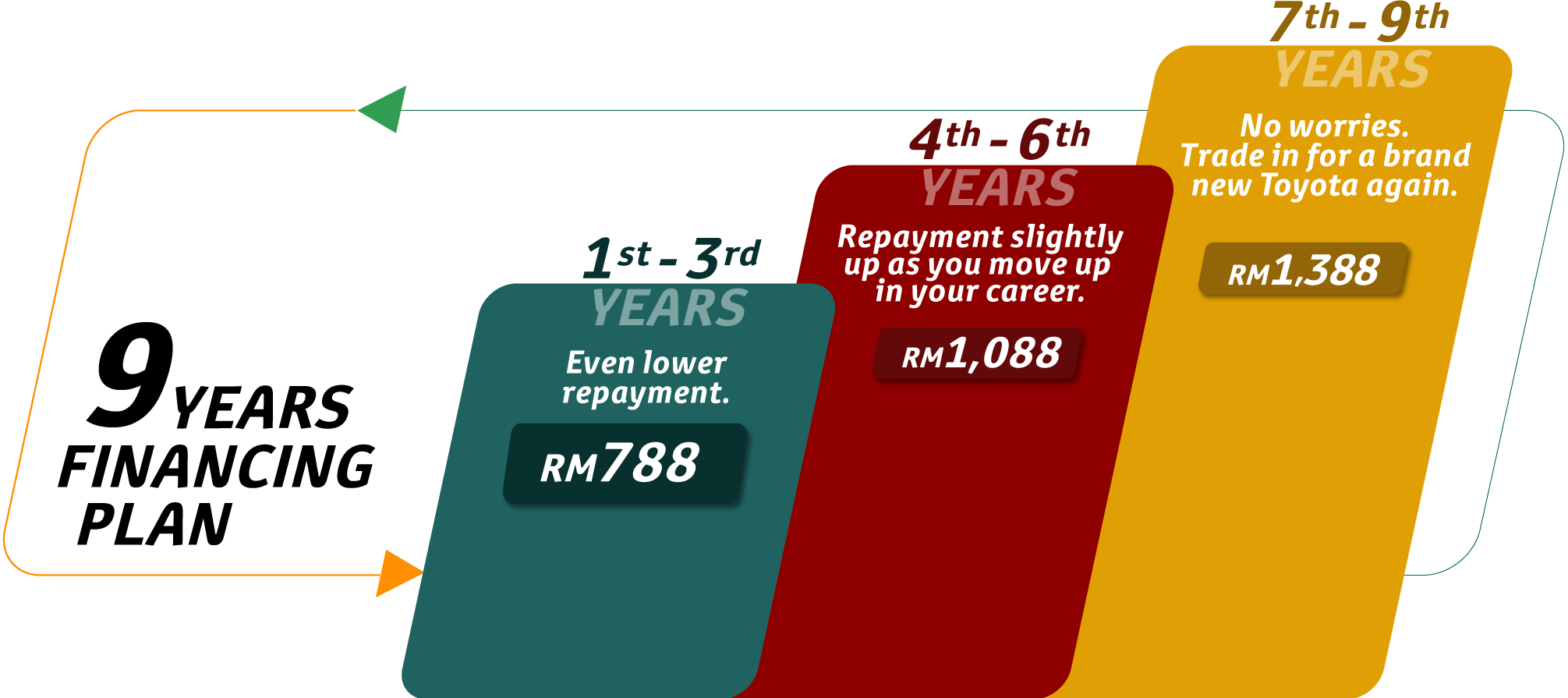

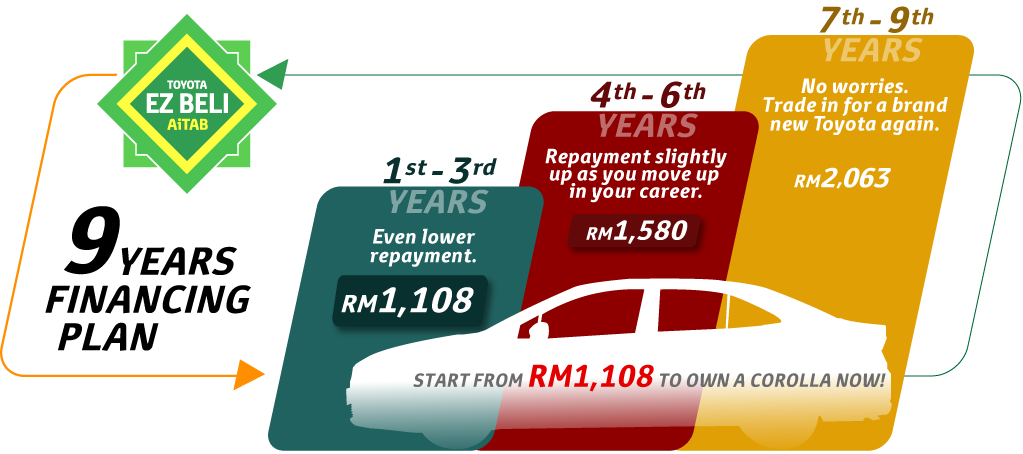

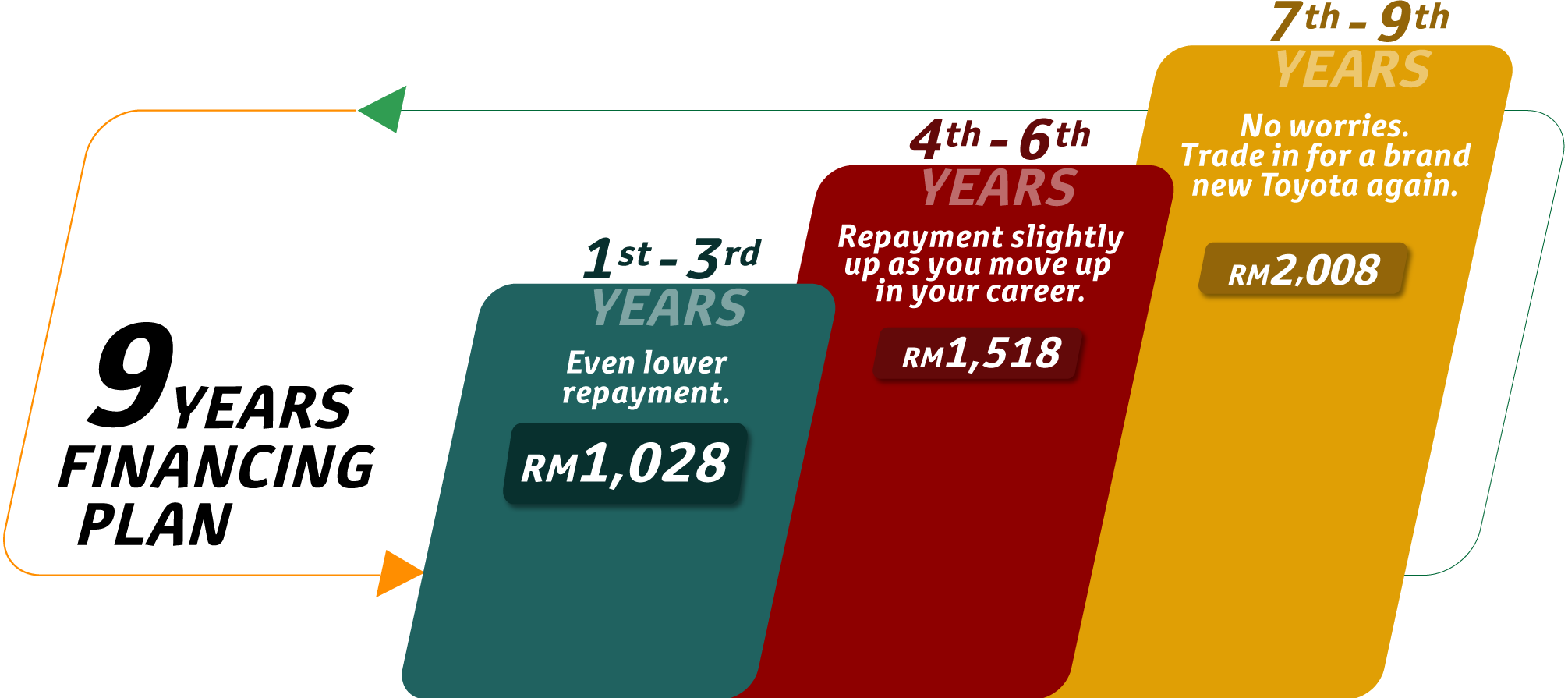

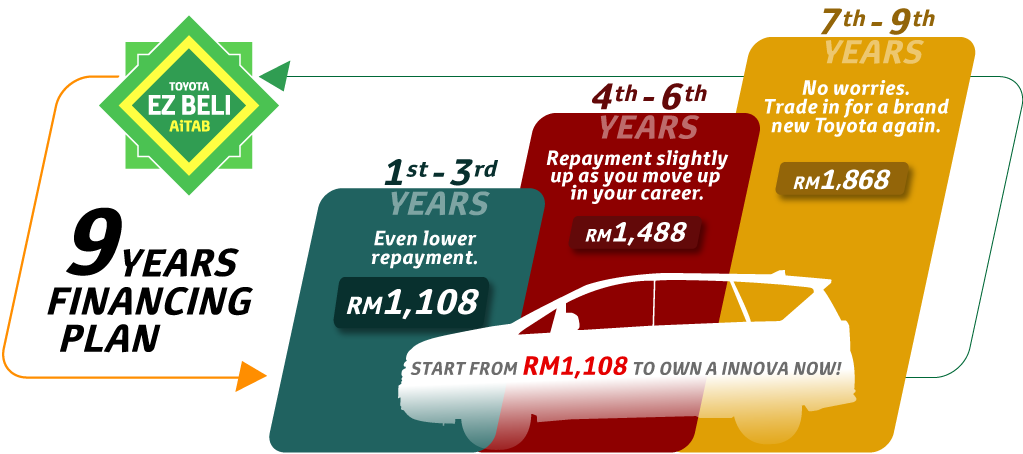

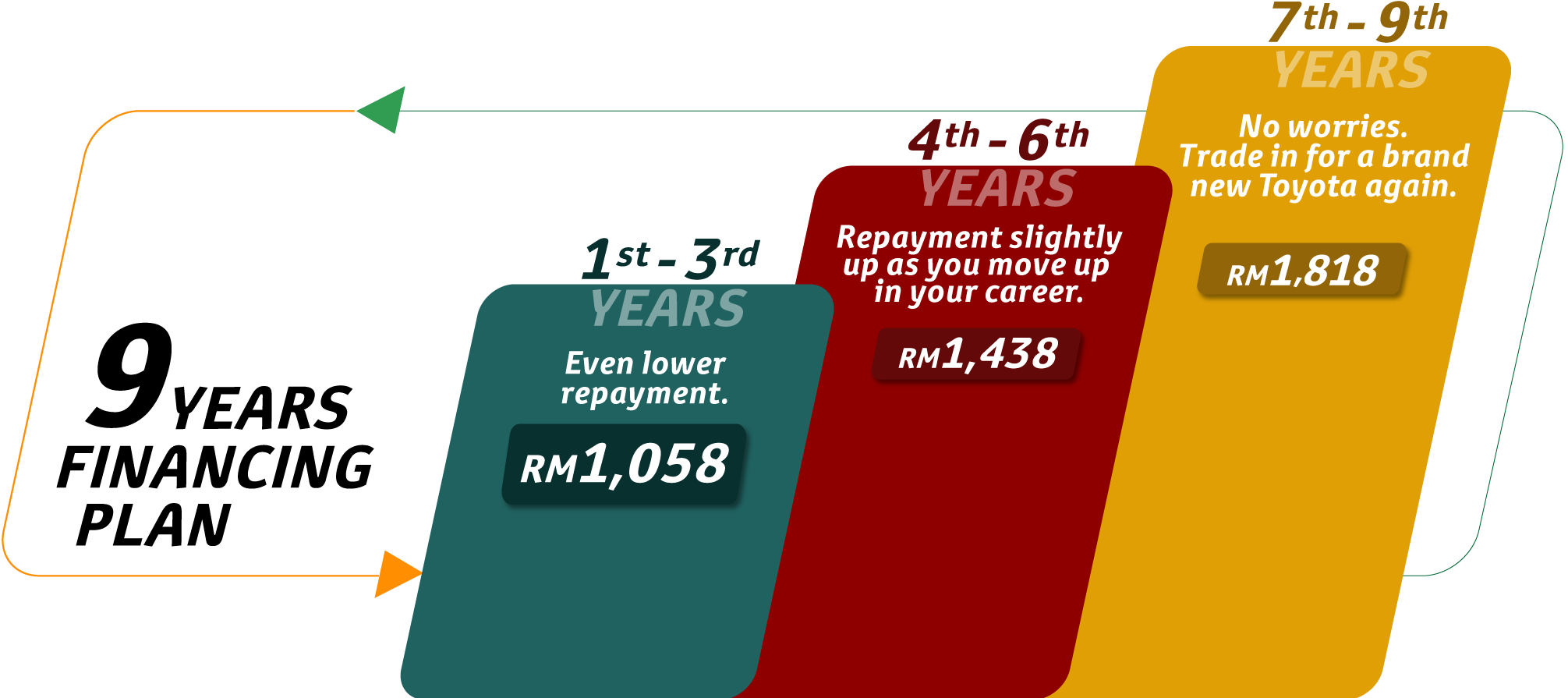

Here's how the unique plan works:

Toyota EZ Beli AITAB is a 9-year financing divided into 4 tiers category for the convenience of you, the customer. Non-Muslim customers are also welcome to enjoy this Islamic automotive financing plan.

Owning a Toyota has never been so easy

Here's how the 4 tiers work for each Toyota car of your dreams:

Benefits

- Shariah-compliant plan with lower monthly repayment for the first 2 years

- Slight increase in Tier 2 (Year 3 - 4) & Tier 3 (Year 5 - 6) in line with your career progression

- Flexible option for Tier 4 (Year 7 - 9): continue repayment OR trade in for a new Toyota

Financing Terms

Financing Terms

| Eligibility | Individuals age 18 years old and above only for Private registrations |

| Margin of finance | Maximum 90% financing , minimum financing amount applies |

| Tenure | 9 years |

EZ Beli AITAB FAQs

EZ Beli AITAB FAQs

-

What is this Toyota EZ Beli AITAB?

Toyota EZ Beli AITAB is an Islamic auto-financing plan, compliant with Shariah principles and available to anyone looking to get their first Toyota, with even lower repayment.AITAB - in a nutshell - is the Islamic version of "conventional" Hire Purchase whereby the parties enter into a lease contract for a specified tenure and subsequently enter into a sale contract at the expiry of the lease tenure.

-

What is the different between this plan compared to other Hire Purchase plan?

Toyota EZ Beli AITAB allows you to enjoy lower monthly repayment with Shariah-compliant in the first 2 years of the lease term and subsequently increase moderately as your career move up. While a conventional Hire Purchase plan requires you to pay the same monthly repayment throughout the financing term. -

I am attracted to your lower monthly repayment in Tier 1. Will I be able to afford the higher repayment in Tier 2 or Tier 3 or Tier 4?

No worries! The repayment in Tier 2 are only slightly higher, with your career moving up, you'll be able to service the repayment. At end of Tier 3, you may choose to trade in the car for a new Toyota with Toyota EZ Beli AITAB again! -

After Tier 3 ended, if I cannot afford the higher repayment in Tier 4, what is my option?

You may opt for early settlement of your car financing. Just trade in your vehicle for a new Toyota, and the trade in value can be used to offset the outstanding balance of your financing. -

Can I pay more in Tier 1, 2 & 3 repayment and what will happen to my financing if I pay more?

Yes, you can pay more in Tier 1, 2 & 3 repayment. The additional payment is treated as advance payment. -

Can non-Muslims enjoy this Islamic automotive financing plan?

Yes. Non-Muslims are welcome to experience this Islamic automotive financing plan

Download Brochures

Download Brochures

| Download Product Disclosure Sheet |

| Product Disclosure Sheet EZBeli | Download |

Explore our auto financing options & Services